|

The 2022 AP US History Free-Response Questions have been released to the public! Click here to view the questions on the College Board's website. 2022 APUSH SAQ Sample ResponsesClick here to view my sample responses to the 2022 APUSH SAQ items. 2022 APUSH DBQ Sample Response(s)Click here to view my sample response(s) to the 2022 APUSH DBQ. This file will be updated to include several sample responses that would earn different point values. 2022 APUSH LEQ Sample ResponsesThis year's LEQ 2 asked students to assess the relative importance of causes for the settlement of the British colonies. Click here to see a set of sample responses I've put together for LEQ 2. Take a look at my analysis of the 2022 APUSH Free-Response Questions on Marco Learning's YouTube channel:

0 Comments

ContextAlexander Hamilton had ambitious plans for building a strong central government with an equally strong credit rating. In order to build public credit, Hamilton pushed a plan for the federal government to assume the war debts that the states had incurred during the Revolution. After resisting the measure initially, Jefferson and Madison agreed to the measure in return for an agreement that the federal capital would be moved to a site on the Potomac River on the border of Virginia and Maryland. Hamilton's Whiskey Tax After the federal government took on over $20 million in new debt, Hamilton’s next step was figuring out how to pay for it. As is often the case in history, the people who were chosen to pay for this new debt assumption were not the people who benefitted most from it or even supported it in the first place. To fund this new debt, Hamilton recommended a federal excise tax on whiskey. An excise tax is a tax on the sale of a product or on a product produced for sale (in this case, the latter). Hamilton’s whiskey tax is also an example of a sin tax, which is placed on goods that are deemed luxurious – or even harmful (today, taxes on cigarettes are an example).

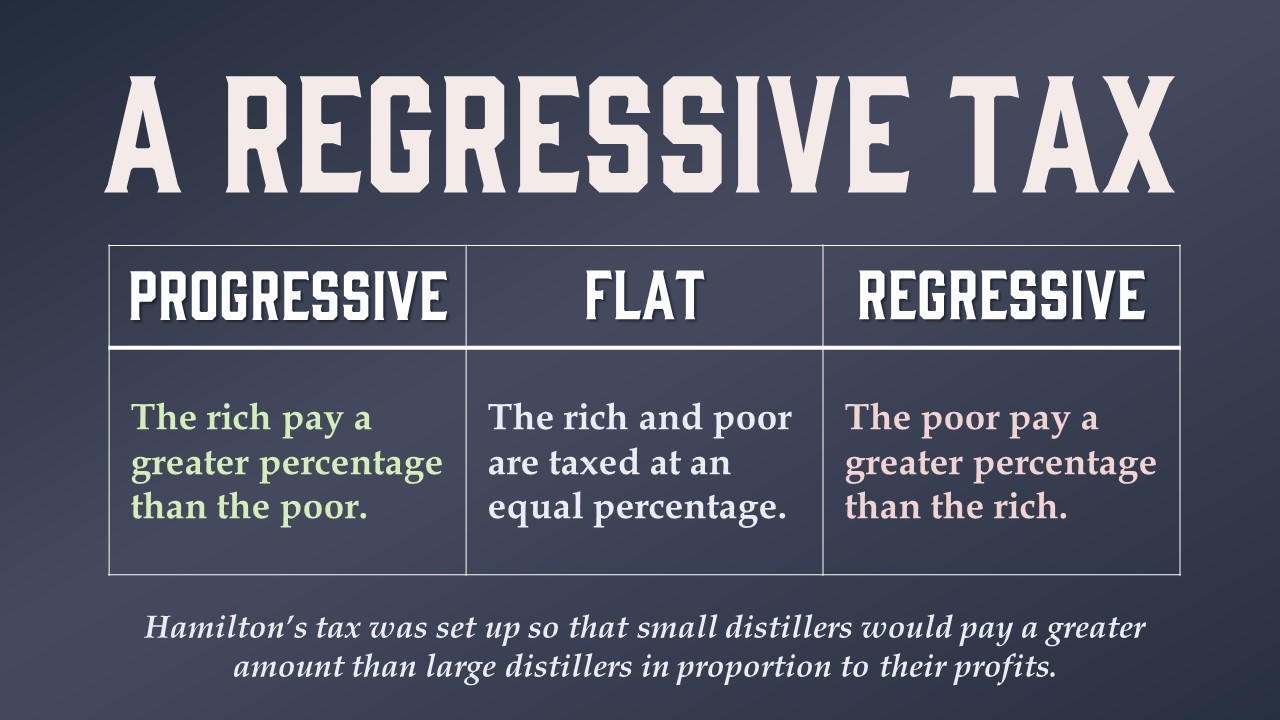

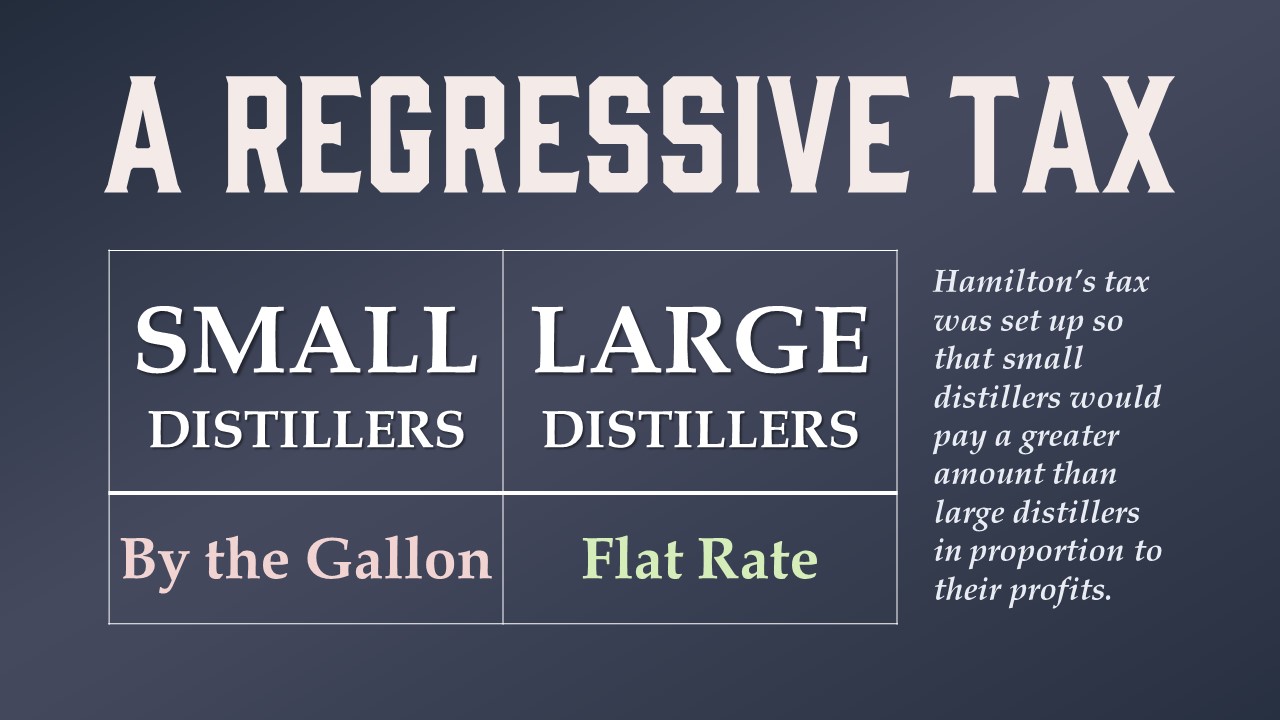

It’s important to note here that Jefferson wanted to explore ways for wine to become cheaper rather than to raise the price of whiskey through taxation. A Regressive TaxHamilton’s whiskey tax hit especially hard in Appalachia, the region of westernmost settlement at the time, where farmers would distill small batches of whiskey for easier transport across the Appalachian Mountains or down the Ohio River to New Orleans. At the time, it was difficult to transport surplus wheat across such long distances, but a farmer could get a good return on a few barrels of whiskey, making for a profitable side hustle for these farmers. Whiskey also served as currency in these Western regions where precious metals and paper money were scarce. Because of these economic realities, Western settlers felt targeted by Hamilton’s tax, which hit them harder than it did Americans living on the Eastern Seaboard. To add insult to injury, Hamilton’s tax was a regressive tax that allowed large distillers to pay a flat rate, while small distillers had to pay by the barrel. At this time, President George Washington was the largest commercial distiller in America. Distillers like Washington could pay a single flat fee and produce as much as they wanted with no additional tax, but Western farmers who lacked the resources to operate on that kind of scale had to pay a tax on every single barrel they produced.

The Whiskey RebellionPopular discontent spread throughout Appalachia and rose to the point of a full-scale rebellion in Western Pennsylvania – specifically, the area around Pittsburgh. The Whiskey Rebellion, as it is known to history, was the third in a line of major frontier settler rebellions. Bacon’s Rebellion in Colonial Virginia and Shays’ Rebellion in Massachusetts during the Confederation Period followed similar patterns of armed uprising by frontier farmers against Eastern elites. While the American Revolution had some features of these rebellions, it was a cooperative effort between frontier settlers and the colonial elites who supported it. The Whiskey Rebellion was the last of these armed uprisings in the early history of the United States. The organizers of the Whiskey Rebellion used a lot of the same rallying cries and methods that had been used a few decades before during the years leading up to the American Revolution. “No Taxation Without Representation,” shouted the disgruntled crowds. Although Western Pennsylvania was represented in Congress, those who protested against the excise tax saw it as similar to the Stamp Act, where an outside government had taxed the colonies without the consent of their colonial legislatures. No one disputed the authority of the new federal government to collect taxes on imports, but the idea of this new government reaching directly into the pockets of citizens struck many people as a repressive throwback to the days of unfair taxation by Parliament. Just as the Sons of Liberty had used tarring and feathering to intimidate tax collectors, the Whiskey rebels tarred and feathered a federal tax collector, forcing him to “ride the rail” through the town in an old humiliation ritual. Escalation According to Ron Burgundy, a widely respected historian and Scotch connoisseur, the Whiskey Rebellion escalated quickly. According to Ron Burgundy, a widely respected historian and Scotch connoisseur, the Whiskey Rebellion escalated quickly. Between 1792 and 1794, things escalated as the unrest in Western Pennsylvania went from a raucous protest to a full-scale rebellion. Threats were made, effigies were burned, tax collectors were assaulted, and finally, shots were fired by organized groups of armed militiamen. In 1794, Washington decided that the rebellion was too large to be contained by local authorities and worthy of federal attention and gained authorization from Congress to call up a federalized militia. The federal government raised an army of 13,000 men to put down a rebel militia whose size was estimated to be around 500. Once the federal militia was assembled, Washington showed up to personally inspect the troops. Although one historian refers to this as “the first and only time a sitting American president led troops in the field,” this isn’t strictly accurate, as following his inspection, Washington left the army under the command of “Light-Horse Harry” Lee, a Revolutionary War officer who was then serving as governor of Virginia. It was Lee who would lead the army into Western Pennsylvania to put down the rebellion. Ironically, Lee was the father of General Robert E. Lee, the most famous person ever to lead a “rebel army” in the history of the United States. The force assembled by the federal government was so overwhelming that it prompted the small rebel militia to disperse before the federal militia even got there. This was viewed as a massive victory for Hamilton and the Federalists, who had sought to demonstrate the power of the new federal government to put down insurrections – an area where the Confederation government had proven to be woefully inadequate while Shays’ Rebellion had raged on for months in Western Massachusetts. In a gesture of clemency, President Washington pardoned two men who were found guilty of treason and sentenced to hang. Jefferson and the Whiskey Rebellion Although Federalists hailed this as an achievement of a strong central government against anarchist elements intent on undermining its authority, Jefferson viewed the federal government’s response as an overreaction to a minor uprising. “An insurrection was announced and proclaimed and armed against, but could never be found,” Jefferson wrote to James Monroe. Jefferson and Madison believed that Hamilton used the rebellion to advance his own partisan political agenda, casting the Federalist Party as the party of law and order and the Republican Party as the party of rebellion and lawlessness. No matter what Hamilton’s motives were, the unceremonious end of the Whiskey Rebellion put an end to a tradition of armed uprisings of disgruntled whites on the western frontier that had spanned over a century. Resistance against federal policies by disaffected whites would be confined to the political sphere until the 1850s, when violence erupted in Kansas in the years leading up to the Civil War. Sin Tax Error?The long-term victory would rest with the Jeffersonians, as no Federalist would ever hold the presidency again after John Adams lost his bid for re-election in 1800. In the years since, Americans have continued to have debates about how government policies affect the less fortunate, both in terms of the use of government police powers and of fair and equitable taxation – a debate that has shown itself most recently in the presidential candidacies of Bernie Sanders and Donald Trump. Appalachian voters, angry with elites in Washington, were a key part of the coalition that elected Donald J. Trump as the 45th President of the United States. Politically, Hamilton’s victory proved to be short-lived, as small farmers in Appalachia put aside their bullets and went to the ballot box in protest. Western areas supported Jefferson’s Republican Party overwhelmingly in the elections that followed, leading to a Republican takeover of the White House and both houses of Congress in 1800. As president, Jefferson signed a repeal of Hamilton’s whiskey tax, along with all internal excise taxes, preferring to fund the government through revenue tariffs. “It may be the pleasure and pride of an American to ask,” Jefferson stated in his Second Inaugural Address, “what farmer, what mechanic, what laborer, ever sees a tax-gatherer of the United States?” Further Reading:

Dumas Malone, Jefferson and the Ordeal of Liberty (University of Virginia Press, 1962) |

Tom RicheyI teach history and government Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed