|

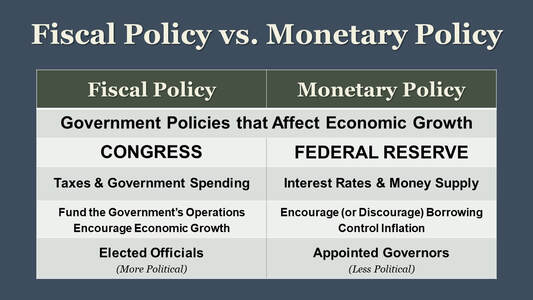

In my latest YouTube video, I explain Fiscal Policy and Monetary Policy to AP Government students.

Monetary Policy, which is set by the Federal Reserve Board of Governors, deals with interest rates and the money supply. The Federal Reserve sets the rate at which banks may borrow from the Fed in the short term, which impacts all other interest rates. High interest rates discourage borrowing and low interest rates encourage borrowing. The Fed also regulates the money supply, determining how much currency is in circulation in order to control inflation. Since the members of the Federal Reserve Board of Governors are appointed by the president and confirmed by the Senate for 14 year terms, monetary policy is not as directly responsive to public opinion as fiscal policy. The Fed is set up as an independent regulatory agency, so it does not answer directly to politicians (though it is not entirely immune to political pressure). Fiscal policy and monetary policy both affect economic growth. For example, Congress may cut taxes in order to stimulate the economy, while the Fed may lower interest rates in order to encourage investment. If you're looking for help preparing for you AP Government exam, check out the online course that I created with my friends at Marco Learning. Click here for more information.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Tom RicheyI teach history and government Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed